Declaration of solvency winding up

What is a declaration of winding up? When to prepare a winding up declaration? Liquidation legally ends or ‘winds up’ a limited company or partnership. There is a different guide if you want to wind-up a partnership).

You’ll need to review the company’s assets and liabilities just before making the declaration. Make a declaration of solvency. Members’ voluntary winding-up –declaration of solvency: In respect of a members’ voluntary winding-up , two directors , where there are only two directors , and a majority of directors , where there are more than two , should make a declaration , called “declaration of solvency‟. In practice, where the members meeting is held at short notice, the declaration of solvency will generally be made the same week. The Declaration of Solvency is made on form Ewhich involves the directors declaring that they have enquired into the affairs of the company and are of the opinion that the company will be able to pay its debts in full within a period of months from the commencement of the winding up.

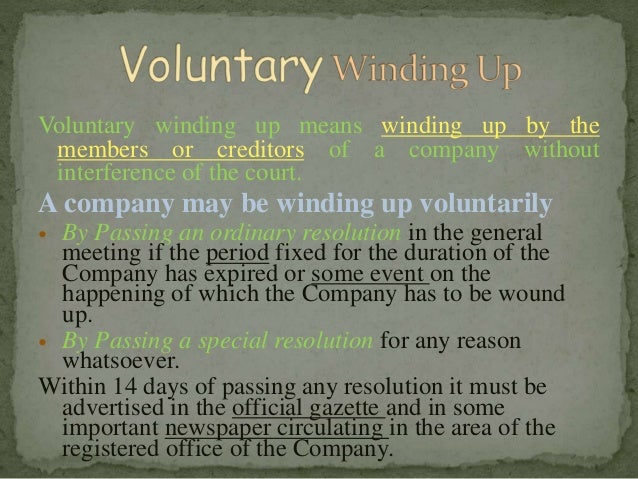

A majority of the company’s directors must make a statutory declaration of solvency in the weeks before a resolution to wind up the company is passed. The declaration should be prepared. In the declaration, the following matters are required to be state namely, (i) that they have made a full enquiry into the affairs of the company, and (ii) that having made such enquiry, they have formed the. Statutory declaration of solvency (1) Where it is proposed to wind up a company voluntarily, the directors (or, in the case of a company having more than two directors, the majority of them) may. It explains how to place a company into voluntary liquidation and the effects of a voluntary liquidation.

Dear Expert, Need format of declaration of solvency for voluntary winding up a private company (as per IBC Code). Applicable Fees: No Fee: Lodging Period: The form must be lodged before notices for the meeting of members to consider winding up the company are issued. Declaration of solvency : – This should be done before the general meeting passing the resolution for winding up and not after the general meeting.

It is a solemn declaration of solvency made by a director that the company is solvent and able to pay all its debts in full within a period of months. A declaration of solvency is required by a mortgage lender and or a buyer when the owner is gifting their share in a property for zero consideration. The board of directors will put the statement of affair and the declaration of solvency in front of the creditors.

If the majority of the creditors are of the opinion that voluntary winding - up should be followe the company will then be wound up voluntarily. Where the declaration of solvency is not made, the winding up is referred to as creditors’ winding up. It is presumed that the company is insolvent. The winding up commences on the passing of the resolution (see paragraph 5). Note: Winding up is deemed to commence when special resolution for winding up is passed.

Within weeks after making the Declaration of Solvency and Statement of Affairs. Liquidator takes into custody or under his control the common seal, cheques, books, documents and all other properties belonging to the Company. Immediately after the EGM. Once a declaration of solvency has been lodge the shareholders must make a special resolution to wind up the company. The required form is a Notification of Resolution ( ASIC Form 2).

You need to provide the shareholders at least days notice in writing of the meeting in which they will pass a vote on the special resolution. Convening EGM within weeks of filing Declaration of Solvency. The role of the liquidator in either case is to collect in the assets and pay off the liabilities.

Where it is proposed to wind up a company voluntarily, its directors, or in case the company has more than two directors, the majority of the directors, may, at a meeting of the Boar make a declaration verified by an affidavit, to the effect that they have made a full inquiry into the affairs of the company, and that, having done so, they have formed the opinion that the company has no debts, or that it will be able to pay its debts in full within such period not exceeding three years. The statutory declaration must also include a. This statement, known as a Declaration of Solvency , must be sworn in front of a solicitor by the directors of the company. Within five weeks of signing a Declaration of Solvency , the shareholders of the company must call a meeting to pass a resolution for winding up and to appoint a licensed insolvency practitioner to act as liquidator. Members voluntary winding up is initiated but liquidator finds the company insolvent. No declaration of solvency If the directors are unable to complete a declaration of solvency , the company has no option but to proceed with a creditors’ voluntary winding up.

File Declaration and Statement of Assets and Liabilities with the Registrar (C ompanies Office of Jamaica) five weeks immediately preceding the date of the passing of the resolution for winding up of the company.

Comments

Post a Comment