Difference between bill and invoice in hindi

Investopedia defines an invoice as “a commercial document that itemizes a transaction between a buyer and a seller. If goods or services were purchased on credit, the invoice usually specifies the terms of the deal, and provide information on the available methods of payment. An invoice is also known as a bill or sales invoice. What is the difference between a bill and an invoice?

The difference between a bill and an invoice is slight but distinct. A Bill is issued after the expenditure you do, like electricity bill , land line and so on. The term Invoice is used when you buy some goods on credit ,that is , you pay it later, usually the payment due date is mentioned on the invoice itself. Is an invoice a bill or a receipt? What are the exact differences between invoices,.

The presentation of an invoice is not an immediate request for payment , and the payment can be made at a later date. A bill , on the other hand , is a request for immediate payment. The bill will also contain information about the purchase and will clearly outline the total amount that needs to be paid.

Export Documentation 5views. Difference between Data. Invoice is a document to raise demand on a customer (usually in case of credit sales ), for the goods supplied to the customer. Based on a copy of the invoice, the concerned customer account will be.

However, whereas an invoice refers to a very specific type of document that contains set pieces of information, a bill is more of a generic term that could apply to a number of different documents – including invoices. One of the main differences between an invoice and a bill is the information it contains. It is okay to receive a bill without an invoice. Businesses can create digital invoices digitally only and generate them with the help of an online invoicing system. It is usually available in PDF or Word format, but it can also be a scanned paper bill.

A bill is something you, as a customer must pay. An Invoice is raised before the payment while cash memo is raised when the payment is made. Signature of the seller or his agent is there in the invoice. Payments may also take complicated forms, such as stock issues or the transfer of anything of value or benefit to the parties. In US law, the payer is the party making a payment while the payee is the party receiving the payment.

In trade, payments are frequently preceded by an invoice or bill. Of course, colloquially, many of us use the word bill for both a bill and an invoice , like the languages I mentioned before. However, there is a technical difference that is important linguistically and legally.

If you’re looking for an invoice , bill , or receipt, then you’re in luck because you’ve come to their home. Where bill and invoice comes before the payment is made, receipt always comes after the payment of the goods received. Talking about the difference in three terms Hence if we see the complete cycle of invoice , bill , and receipt, then we could say that seller sent the invoice to the customer to pay the amount for the product or services that are already provided to him.

So, let’s take a look at each one so you can be clear about what documents to refer to when you need to and learn the difference between an invoice , a bill and a receipt. In other words, not all bills are invoices , but all invoices are bills. The Bill of Rights is not an invoice. Middle East and North Africa, connecting job seekers with employers looking to hire. A delivery challan is simply a document stating what goods have been delivered to whom, where on what date.

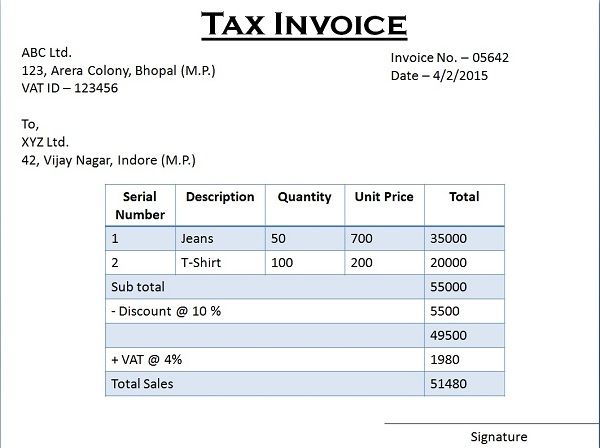

Retail invoice should contain the same details in tax invoice except TIN of purchaser. A retain invoice may also be in the format for tax invoice. But on the top of the invoice , instead of tax invoice , retail invoice should be printed.

Comments

Post a Comment