Recipient created tax invoice xero

How to create a tax invoice? However, in particular industries, you may have an agreement with the seller for you to determine the price of the goods you are buying. Could a provision be made for recipient created invoices. Merged: Buyer Created Tax Invoices.

It would be great if we could produce buyer created tax invoices out of Xero instead of using the work around of entering them as a bill and then creating compliant invoices out of word or excel. This is common in many industries especially where the purchaser has to assess the quality, quantity or price of the goods after they are delivered. It seems like a really simple thing to do, but it’s probably not there on their priority list just yet.

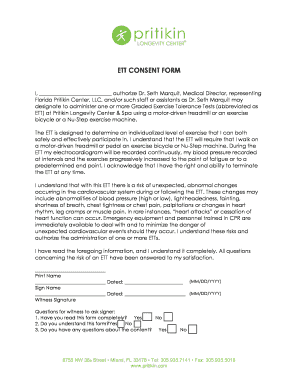

But when things like that happen, that doesn’t mean that you can’t solve the problem. You can just put a temporary solution in place. Industries such as agriculture are often in receipt of income that they are not price setters such as sale of Milk or wheat. When the recipient (you) of goods and services creates the tax invoice on behalf of the supplier , this type of tax invoice is known as a recipient created tax invoice (RCTI ). Setup a Self-Employed Contractor in Invoxy. As I called the ATO and they said that the RCTI is the invoice and I am not allowed to create a TAX INVOICE as the RCTI is the invoice.

So I am not sure how to account for this in XERO. GST into my business account. Note: This video is for our NZ and Australian based customers. Recipient-created tax invoices. A recipient - created tax invoice must be created and sent from outside of Xero accounting software.

Learn more about the benefits of sending e- invoices in Xero. Not all accounting software was created equal. Follow this guide to. To enable this, you will have to enter the Xero network key to a contact name before you can start sharing sales invoices and bills through the Xero to Xero network. It is used where a product is consigned to another party for sale, who after completing the sale will withhold costs incurred in the sale.

If you have Invoice Manager for Excel installe the automatic invoice numbering feature is able to generate invoice numbers for you. Tax invoices are usually issued by whoever is supplying the goods or services. However, in special cases, the recipient of the goods or services may create a tax invoice and send it to the supplier (sometimes with payment).

This is known in Australia as a recipient created tax invoice (RCTI), or in New Zealand a buyer created tax invoice. With invoicing in Xero , it’s easier and more efficient than ever to invoice your customers. Let Xero keep track of the critical details so you can spend more time growing your business.

As the customer receiving the goods or services, a recipient created tax invoice is entered the same way as any other bill. If you are only sending out invoices for paid invoices , you could create a invoice branding theme that includes “Receipt” on it. Xero invoices when paid will show the payment details. Invoices sent from Invoxy create draft accounts receivable invoices in Xero , so you can manage your aged debtors and reconcile your accounts in no time. Automatically assign revenue to different Xero account codes and create new Xero contacts from your clients in Invoxy.

Build Time: hours. The JO platform handles all invoicing for you as a worker by creating an recipient created tax invoice for you (RCTI). In simple terms this is an automated platform generated worker invoice from you to the JO finance department with all the correct information the JO accounts team need to successfully release payment to you. Sharing an approved sales invoices to a customer will automatically appear on their Xero account as a draft Bill.

Sharing a Bill to a supplier will automatically appear on their Xero account as a draft sales invoice. If you are using the accounting sync, then the auto-sync will continually pass payment information as well as invoices created in Invoiced. Creating a new sales invoice in Xero is easy. In this tutorial, we will create a sales invoice in Xero ’s demo company before previewing how it will look to the customer and discussing at a few options for saving or approving it. Sales Invoices Section in Xero.

Sometimes business owners are required to create tax invoices on behalf of their suppliers. This type of tax invoice is known as a recipient created tax invoice (RCTI). For more specific information about the RCTI, go to our blog here – there’s a free fact sheet to download! When you make it easier for your customers to pay you by using E-invoicing and issuing invoices with Xero ’s online invoicing feature, you can get paid faster.

Entering the receipt of a cheque together with a recipient.

Comments

Post a Comment