Xero difference between bill and invoice

What is the difference between a bill and an invoice? An invoice is a document that charges a customer for goods or services you’ve provided. Also called a bill, an invoice shows all the information about a transaction. This includes: the quantity of any goods or services provided. Just a functional difference, achieves the same result.

A bill will create an accounts payable invoice to be paid - which you can throught he owners contribution account (ensure that this chart code has enable payments ticked). A bill is a document that is handed over by the seller to the buyer which acts as a request for payment. Invoice maybe presented before or after the goods are delivere and it is not an immediate request for payment.

A bill , on the other han is a request for immediate payment. You walk into a store and purchase supplies and you pay with card. You enter this transaction enter Xero as Spend Money and then when your bank feed comes through, you reconcile the account.

Bill is for exactly that. Investopedia defines an invoice as “a commercial document that itemizes a transaction between a buyer and a seller. If goods or services were purchased on credit , the invoice usually specifies the terms of the deal, and provide information on the available methods of payment. For audit purposes the voided invoice will still be listed in invoices but will not affect the accounts.

Sometimes invoices will get duplicated on an import or client set up (or if a client is setting up their own books and then needs help cleaning up their books). Once the Draft invoices are approve they have to be voided one at a time. Being able to void multiple invoices at a time would be a huge time saver!

Also, if you’re paying multiple invoices at once, you can’t enter a single, unique reference number. Just be mindful that if you have multiple people entering bills in. Using the bill function is to manage your creditors, as you say generally where you receive an invoice and have x number of days to pay. This is so you can do reports at any one time and see how much you owe.

If you pay everything on the day straight away, there is not a lot of value in using the bill function. This video tutorial shows you how to create repeating invoices and bills in Xero accounting software. Rather than creating a brand new invoice or bill every time, Xero does the work for you. Managing your bills and purchases in Xero accounting software helps you stay organise stay on top of cashflow and pay your suppliers on time.

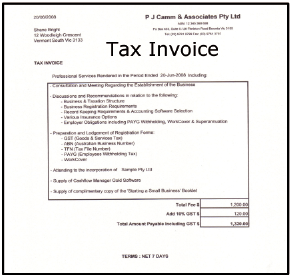

Invoices come in many varieties, each with their own name. Here are some of the more common. Sales invoice If you send an invoice , then it’s a sales invoice (if you receive it, it’s a purchase invoice ). GST-registered businesses send tax invoices. Xero saves you time by letting you make a copy of the last invoice you sent to a customer. Just update any parts that you need to and send it off to the customer.

Reduce the time between sending an invoice and receiving payment using online invoicing. Fully automate your invoices , purchase orders and payments from Autotask to Xero. Set up in under minutes and try free for days! If the option is not available you might have a payment or few attached to your invoice.

The difference between a bill and an invoice is slight but distinct. The term Invoice is used when you buy some goods on credit ,that is , you pay it later, usually the payment due date is mentioned on the invoice itself. When do you record revenue or expenses?

If you do it when you pay or receive money, it’s cash basis accounting.

Comments

Post a Comment